south dakota used vehicle sales tax rate

The South Dakota sales tax rate is 4 as of 2022 with some cities and counties adding a local sales tax on top of the SD state sales tax. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax.

States With No Income Tax Explained Dakotapost

If you want to buy cars South Dakota is among the top ten most tax and fee-friendly places in the US.

. 31 rows The state sales tax rate in South Dakota is 4500. The sales tax on a used vehicle is 5 in North Dakota. 366 rows Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax.

The current total local sales tax rate in rapid city sd is 6500. First multiply the price of the car by 4. Mobile Manufactured homes are subject to the 4 initial.

South dakota has a statewide. Rates include state county and city taxes. Different areas have varying additional sales taxes as well.

The Motor Vehicle Division provides and maintains your motor vehicle records. The SD sales tax applicable to the sale of cars. The South Dakota sales tax and use tax rates are 45.

The sales tax on a used vehicle is. 2020 rates included for use while preparing your income tax deduction. Print a sellers permit.

The South Dakota sales tax rate is currently 45. The highest sales tax is in Roslyn with a. - All sales of vehicles by auction are subject to either sales or use tax or motor.

Subject to the sales and use tax based on the lesser of 5 of the total lease payments plus other charges. South Dakota has a 45 statewide sales tax rate. That is the amount you will need to pay in sales tax on your.

The states with the highest car sales. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Though you can save money you know the payments involved to register your car with.

Review and renew your vehicle registrationdecals and license plates. Its important to note that this does include any local or county. The South Dakota sales tax and use tax rates are 45.

To calculate the sales tax on a car in South Dakota use this easy formula. The South Dakota use tax should be paid for items bought tax-free over the internet bought while traveling or transported into South Dakota from a state with a lower sales tax rate. South dakota charges a 4 excise sales tax rate on the purchase of all vehicles.

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. In addition to taxes car. Rate search goes back to 2005.

- Use tax is not due if the vehicle is purchased from a person and not from a business. For tax rates in other cities see south dakota sales taxes by city and county. Our online services allow you to.

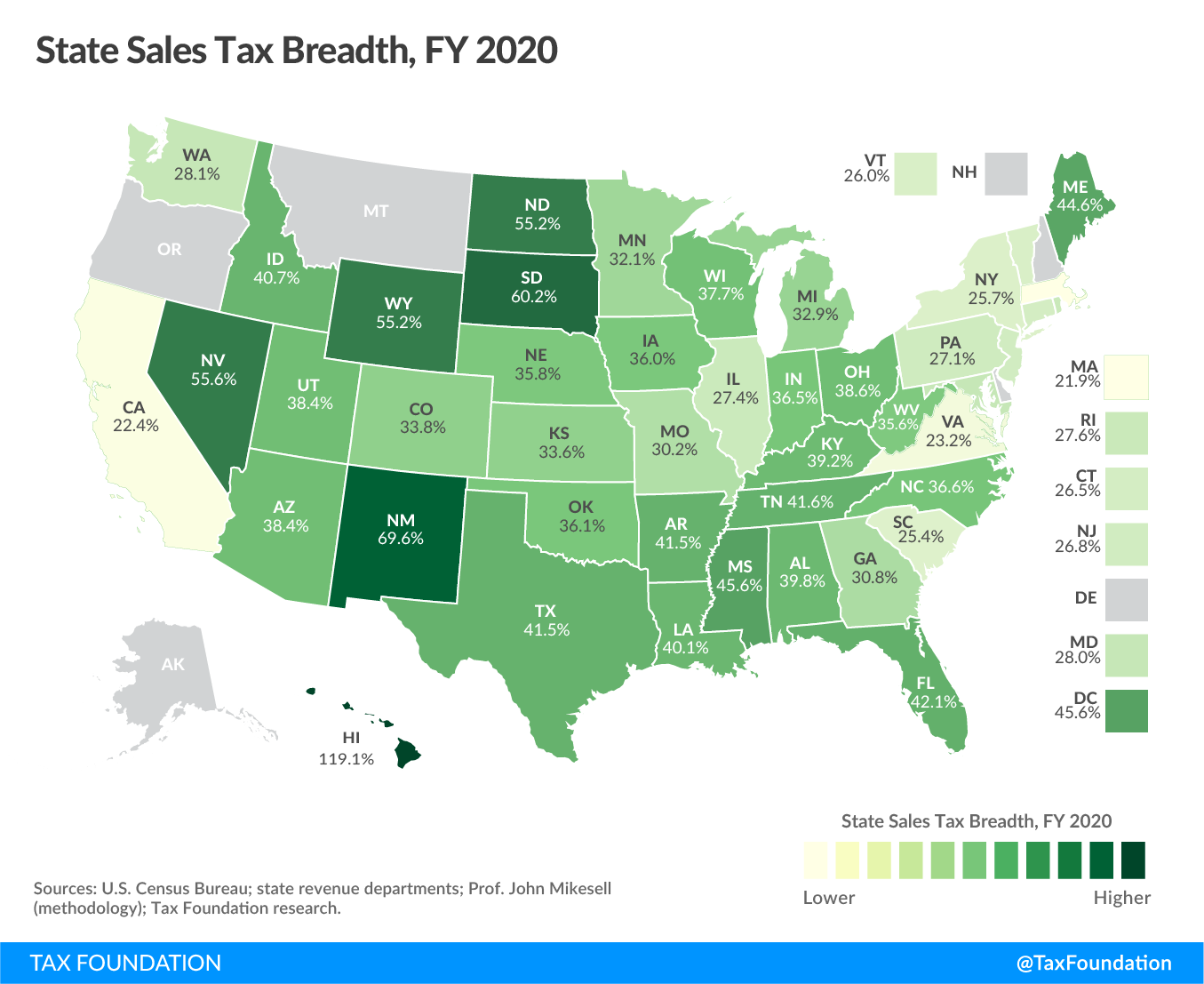

The date that you. State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation South dakota used vehicle sales tax rate. South Dakota has a 45 statewide sales tax rate but also has 289 local tax jurisdictions including cities towns counties.

All car sales in South Dakota are subject to the 4 statewide sales tax. For vehicles that are being rented or leased see see taxation of leases and rentals. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

The latest sales tax rates for cities in South Dakota SD state.

Understanding California S Sales Tax

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Tax Laws By State Ultimate Guide For Business Owners

Montana Sales Tax Rates Avalara

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Use Tax South Dakota Department Of Revenue

South Dakota Estate Tax Everything You Need To Know Smartasset

What S The Car Sales Tax In Each State Find The Best Car Price

All Vehicles Title Fees Registration South Dakota Department Of Revenue

What New Car Fees Should You Pay Edmunds

South Dakota Sales Tax Small Business Guide Truic

Repeal Of Food Sales Tax Rejected By South Dakota Senate Mitchell Republic News Weather Sports From Mitchell South Dakota

What S The Car Sales Tax In Each State Find The Best Car Price

States With The Highest And Lowest Sales Taxes

State Sales Tax Base And Reliance Fy 2020 Tax Foundation

States With No Sales Tax On Cars

Nj Car Sales Tax Everything You Need To Know

What S The Car Sales Tax In Each State Find The Best Car Price